how to take an owner's draw in quickbooks

Typically that means receiving a base salary and a portion of the profits. You should already have an owners draw account if you selected sole proprietor when setting up quickbooks.

Learn How To Record Owner Investment In Quickbooks Easily

You are responsible for making your quarterly estimated payments.

. When entering a check written to the owner for personal expenses post the check to her draw. Now hit on the Chart of Accounts option and click new. Click on the Banking and you need to select Write Cheques.

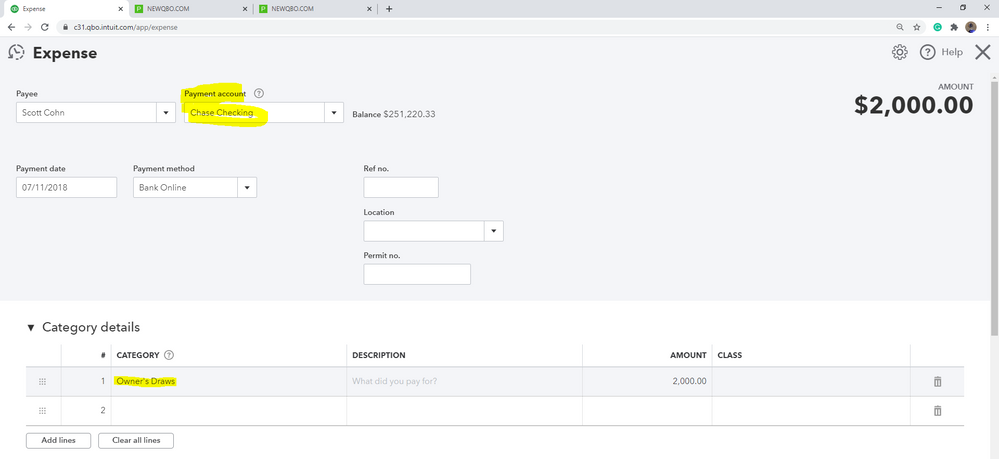

You can also take money out of the partnership. Before you can record an owners draw youll first need to set one up in your Quickbooks account. In the window of write the cheques you need to go to the Pay to the order section as a next step.

Taxes are not included. Navigate to the Account Type drop-down and select the Equity tab. Before you can pay an owners draw you need to create an Owners Equity account first.

Smith Draws Post checks to draw account. First of all login to the QuickBooks account and go to Owners draw account. If not go to your chart of accounts to create a new account and select equity as the type.

You can either enter a checkexpense and use. At the bottom of the Chart of Accounts page you should see an option titled Accounts click it and choose New. Now you need to choose the owner and enter an amount next to the currency sign.

Here are few steps given to set up the owners draw in QuickBooks Online. Go to Settings and select Chart of accounts. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg.

In the Write Checks window go to the Pay to the order of section select the owner and enter an amount next to the sign. Answer 1 of 5. Heres how you create an Owners Equity account.

If your business is formed as a partnership each partner will be paid distributions based on the partnership agreement. Open the QuickBooks Online application and click on the Gear sign. Select Equity and Continue.

Create an Owners Equity account. From the Account Type dropdown choose Equity. Setting Up an Owners Draw.

Click Save Close to record the check. In the detail area of the check assign the amount of the check to the equity account you created to record the owners draws. Visit the Lists option from the main menu followed by Chart of Accounts.

Go to Banking and select Write Checks. Select the Owners Equity and. Learn about Recording an Owners Draw in Intuit QuickBooks Online with the complete ad-free training course here.

In the Chart of Accounts window select New.

How Do I Pay Myself Owner Draw Using Direct Deposit

How Do I Enter The Owner S Draw In Quickbooks Online Youtube

How To Pay Invoices Using Owner S Draw

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

How Do You Set Up An Owners Draw Without Using Che

Quickbooks Online Tutorial Recording An Owner S Draw Intuit Training Youtube

Setup And Pay Owner S Draw In Quickbooks Online Desktop

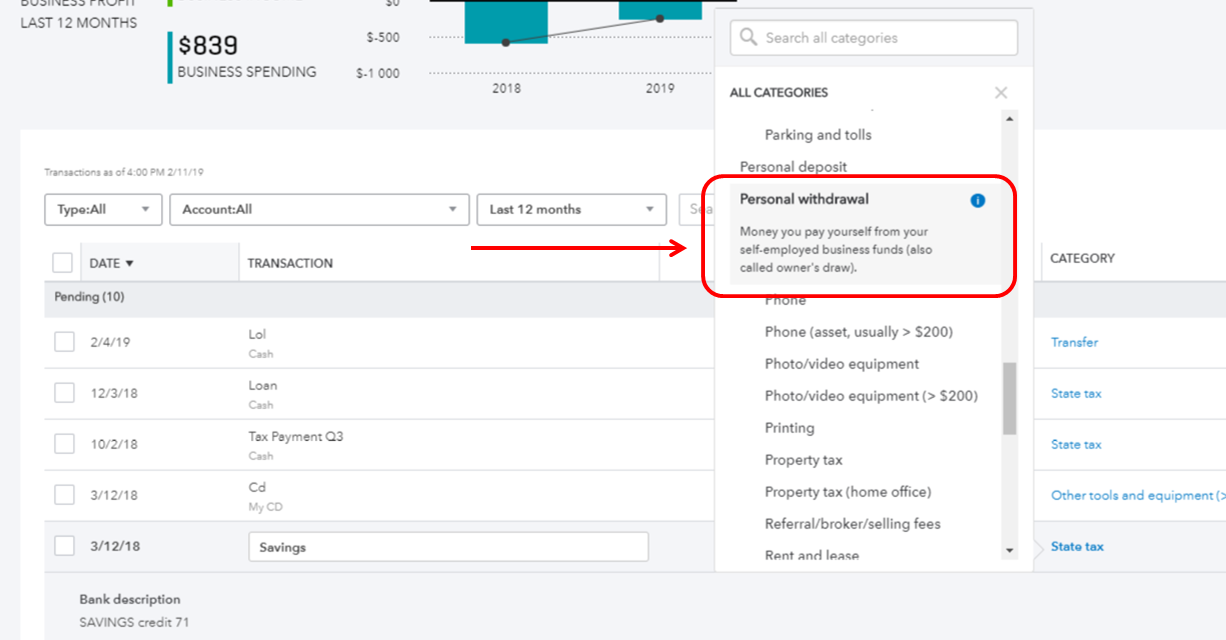

Solved Owner S Draw On Self Employed Qb

Owner S Draw Quickbooks Tutorial

Solved Owner S Draw On Self Employed Qb

How To Record An Owner S Draw The Yarnybookkeeper

How To Record Owner Investment In Quickbooks Updated Steps

How To Setup And Use Owners Equity In Quickbooks Pro Youtube